Yves Smith: There Are No Free Markets (Emertius Prof. Richard Murphy)

Yves Smith posts a transcript from Emertius Prof. Richard Murphy's podcast arguing that There Are No Free Markets.

Prof. Murphy concludes:

What this means is that we require a broader understanding of capital. Markets claim that they exist to serve the interests of financial capital, and the entire accounting systems that we have in our economies now are designed for that sole purpose.

The truth is, financial capital is a derivative form of capital. In other words, it has no value in itself; it only exists because there are real forms of capital which actually sustain our economy, and they are

- productive capital, the things that we use to make stuff;

- human capital, the investment in our knowledge and our well-being and our health and our care;

- social capital, the institutions of state that ensure that markets can be regulated for all the reasons I’ve noted in this video, plus, of course,

- environmental capital.

We need to look after this world that we live upon.

Ignore all of these, and we guarantee long-term failure, and yet our antisocial neoliberal system of financial capitalism ignores almost altogether the value of our productive human, social and environmental capital. So, what we need now is not deregulation; what we need is regeneration, strong institutions, effective regulation, and empowered participants in markets, which means you and me.

Markets must be redesigned to serve society and not dominate it.

This is the goal for 2026 and what I will be talking about. This requires a politics of care: care for people, care for institutions, care for the environment, care for the future. Markets are just tools. The state sets their purpose. We need to reset that purpose, and democracy provides legitimacy.

There are no free markets. There never have been. Markets only exist because states make them possible, and they fail when regulation does. So, in that case, if we want markets that work, we must rebuild the state, rethink capital, and restore democratic accountability.…

Emphasis Mine

In essence, Prof. Murphy argues that the state is critical for the formation and operation of markets:

- Currency needed for liquidity of the market is created and regulated by the state.

- Actors, such as corporations, are created and regulated by the state.

- Free flow of information needed for market transparency is enforced by the state.

- Consistency of information needed for informed participation in the market is enforced through accounting standards which are mandated and enforced by the state.

- Contracts needed for predictable trade flows are created under laws made by the state and disputes are resolved by the state institutions such as courts.

In other words, markets cannot be free of state control. Thus, he argues that a free market is an oxymoron.

Some economists can argue that markets existed before the formation of states. Here they are referring to farmers' markets in which all participants were known to each other, and thus social pressures kept these markets functional for barter exchange. It is when markets expand beyond a tight social circle that state intervention is required.

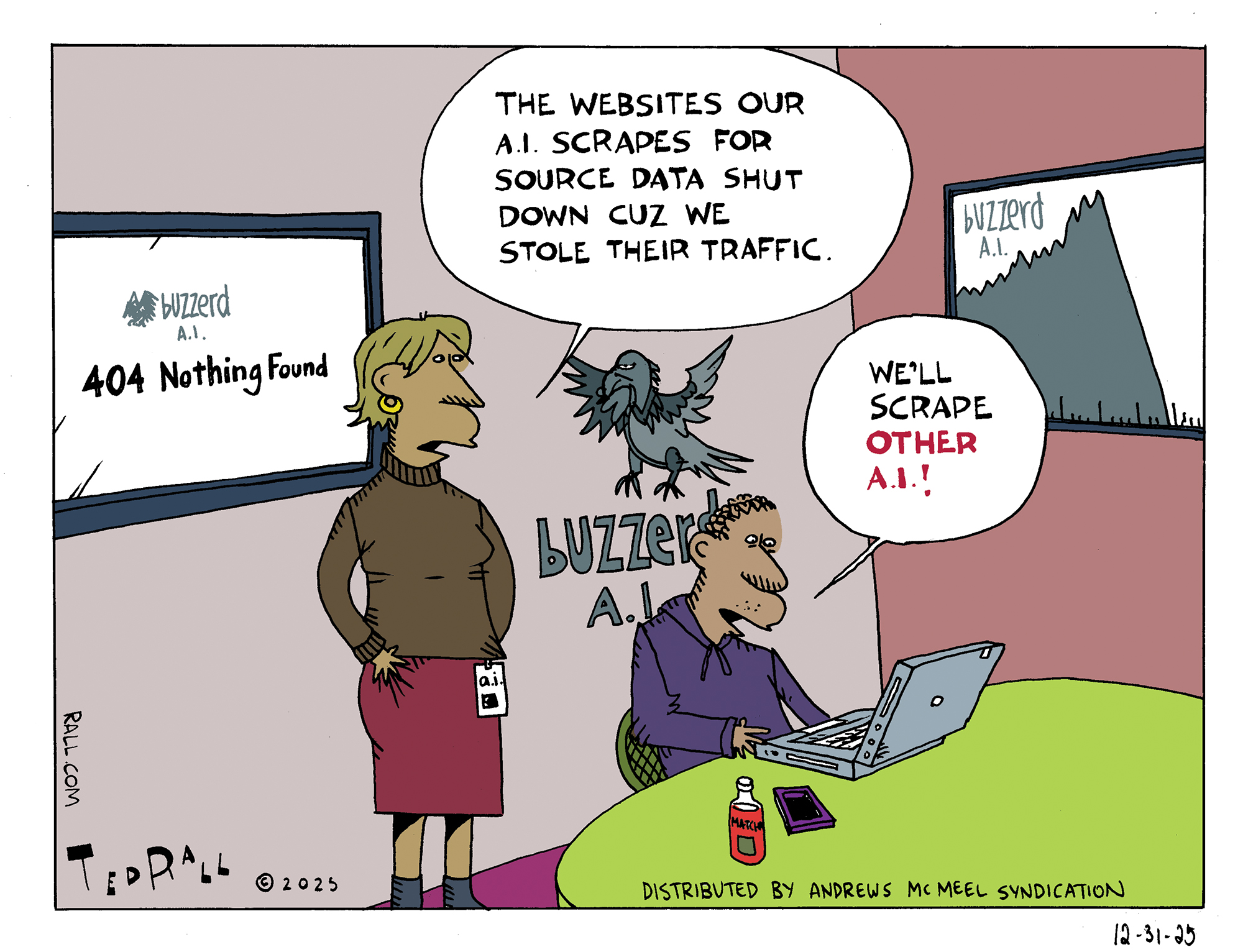

AI Disclosure: Image was generated by Google Gemini

Read more!